In a surprising move, Rolex has closed Carl F. Bucherer, a brand that's been around for 137 years. Financial struggles led to consistent losses, with reported deficits of about 250 million francs. Despite its rich heritage, the brand couldn't achieve profitability in today's competitive luxury market. Rolex's decision highlights the challenges even storied brands face. If you want to know more about the implications of this closure, you'll find quite a bit to learn.

Key Takeaways

- Rolex acquired Carl F. Bucherer in 2023 but decided to close the brand due to financial struggles and consistent operating losses.

- The brand reported losses of around 250 million francs, with annual sales insufficient for profitability.

- Closure affected approximately 250 retail locations globally, marking a significant shift in the luxury watch market.

- Employees were offered positions at Rolex to support their transition and minimize job security concerns.

- The closure highlights challenges for legacy brands in the competitive luxury watch industry, emphasizing that heritage alone doesn't ensure success.

When Rolex acquired Carl F. Bucherer in 2023, it marked a significant shift in the luxury watch landscape. Founded in 1888 in Lucerne, Switzerland, Carl F. Bucherer had been a family-owned brand for three generations, known for its unique movements and a rich legacy. Despite its storied history, the brand struggled financially, consistently operating at a loss. Even during its best years, achieving annual sales of 80 to 100 million francs wasn't enough to sustain profitability.

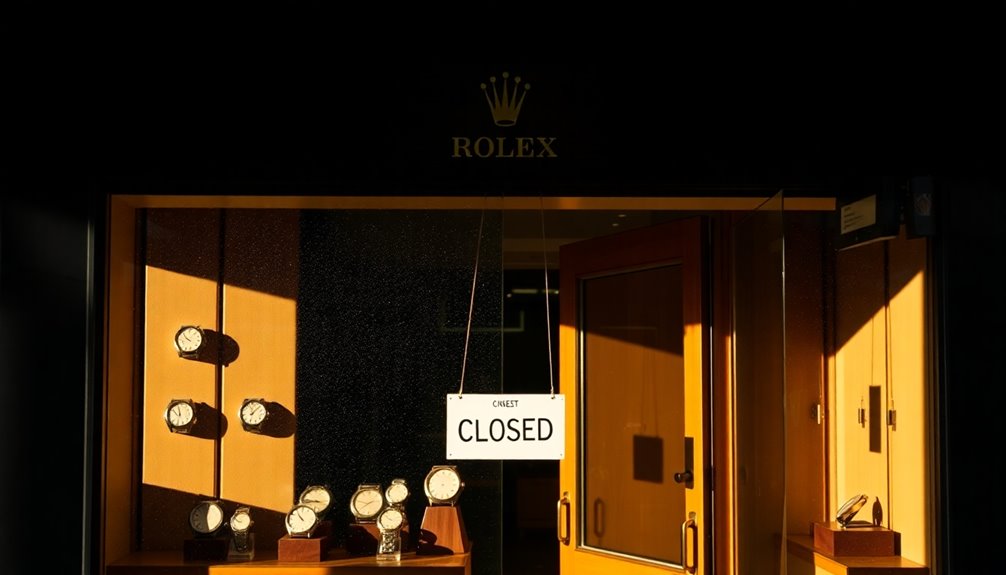

The decision to close Carl F. Bucherer came as a surprise to many, but financial considerations drove it. With reports indicating the brand had lost around 250 million francs through its investment, Rolex deemed it less profitable compared to its other segments. Following the closure announcement, the process began, phasing out CFB products from approximately 250 retail locations worldwide. This move followed the recent acquisition of Bucherer AG by Rolex.

This decision didn't just affect the brand but also the employees, who were offered positions at Rolex, helping ease the transition.

As the closure unfolds, you might wonder about the impact on the luxury watch market. The end of Carl F. Bucherer signifies a loss for Swiss watchmaking, highlighting the challenges legacy brands face in a competitive landscape. The market dynamics show that heritage alone doesn't guarantee financial success.

Collectors might find an increased interest in past Carl F. Bucherer models, creating a nostalgic demand for pieces that embody traditional craftsmanship and modern innovation.

Moving forward, retail spaces previously occupied by CFB products will be replaced by other luxury brands. This shift illustrates the continuous evolution within the luxury watch industry, where adaptability is crucial.

The closure of Carl F. Bucherer serves as a poignant reminder of the complexities in luxury brand management, leaving enthusiasts and collectors reflecting on what this means for the future of watchmaking in Switzerland.

Frequently Asked Questions

What Factors Influenced Rolex's Decision to Close the Watch Brand?

Several factors influenced Rolex's decision to close the watch brand.

You'll find that financial performance played a crucial role, as the brand struggled with profitability despite solid sales.

Losses incurred from investments also weighed heavily.

Additionally, intense market competition made it difficult to establish a strong presence.

Ultimately, these challenges led Rolex to conclude that discontinuing the brand was the best course of action for their overall strategy.

How Will This Closure Affect Existing Customers of the Brand?

The closure of Carl F. Bucherer will likely impact you as an existing customer in several ways.

You may face uncertainty regarding customer service and support for your watch, especially concerning warranties and maintenance.

Additionally, as retail locations phase out, finding parts or services could become challenging.

On the upside, your watch might gain collectibility, potentially increasing its value in the market.

Communicating with the brand during this transition will be crucial for your experience.

Are There Any Plans to Revive the Closed Watch Brand in the Future?

There aren't any plans to revive Carl F. Bucherer, and that's significant considering it generated annual sales between 80 and 100 million francs at its peak.

With Rolex focusing on its core brands and integrating former employees, it seems the closure is permanent.

While collectors might still cherish past models, the brand itself won't return, marking the end of an era in Swiss watchmaking that won't be easily forgotten.

What Legacy Does the 137-Year-Old Watch Brand Leave Behind?

The 137-year legacy of Carl F. Bucherer leaves you with a rich tapestry of Swiss watchmaking excellence.

You'll appreciate its blend of traditional craftsmanship and modern innovation, making it a respected name in luxury watches.

Despite financial struggles, its commitment to quality and unique movements set it apart in the industry.

The closure signifies not just the end of a brand, but a poignant moment in watchmaking history that you won't soon forget.

How Does This Closure Impact Rolex's Overall Business Strategy?

The closure of Carl F. Bucherer significantly impacts Rolex's overall business strategy by allowing you to refocus resources on more profitable brands.

It streamlines your brand portfolio, enhances market positioning, and reduces internal competition. This decision aligns with your goal of prioritizing quality and profitability, ensuring that you maintain a strong market presence.

As you concentrate on core brands, you're likely to see improved operational efficiency and increased brand visibility within the luxury watch segment.

Conclusion

In closing a storied 137-year-old watch brand, Rolex highlights the ever-evolving landscape of luxury timepieces. This decision, while surprising, underscores the need for innovation and adaptability in a competitive market. Just like when Patek Philippe acquired the respected brand, Breguet, to enhance its own prestige, Rolex’s move could reshape the industry. As a consumer, it’s crucial to stay aware of how these shifts might affect your favorite brands and the value they hold in the watch community. This farewell to a historic brand also calls attention to emerging collaborations that are redefining luxury. For instance, the recent Longines and Henry Cavill partnership showcases how brands can leverage celebrity influence to drive relevance and engagement in today’s market. As the watch community adapts to these changes, enthusiasts should remain discerning about the implications of such partnerships on brand value and heritage.